We didn’t expect this news section to be all bad, but the latest events are begging to differ. Sigh.. Here we go again.

But even if it’s painful. it’s important to understand what’s actually going on in the crypto world and unravel its yet another crash.

So if you’re curious as to why is the crypto market crashing in June of 2022, make sure to keep on reading!

The (Not So) Great Beginning

It all started in a galaxy far, far away – or rather – on the 12th of June, 2022 when the Celsius Network company froze withdrawals, swaps, and transfers.

If you haven’t yet heard about Celsius, and no not the unit of temperature, it is a loaning company operating within crypto with Alex Mashinsky and S. Daniel Leon as its founders. Celsius operates globally with official offices in four countries and their Headquarters located in Hoboken, New Jersey.

So – what was this all about?

Starting from the basics – Celsius made it possible for its users to either:

- Stake crypto, such as BTC or ETH in a Celsius wallet and earn a percentage yield, or

- Take out loans using their crypto put in as security

The company successfully operated from its beginnings in 2017, serving millions of clients and operating with quite some sums of money. Moreover, Celsius Network is also one of the biggest players in Bitcoin mining in North America having over $200 million dollars invested in mining.

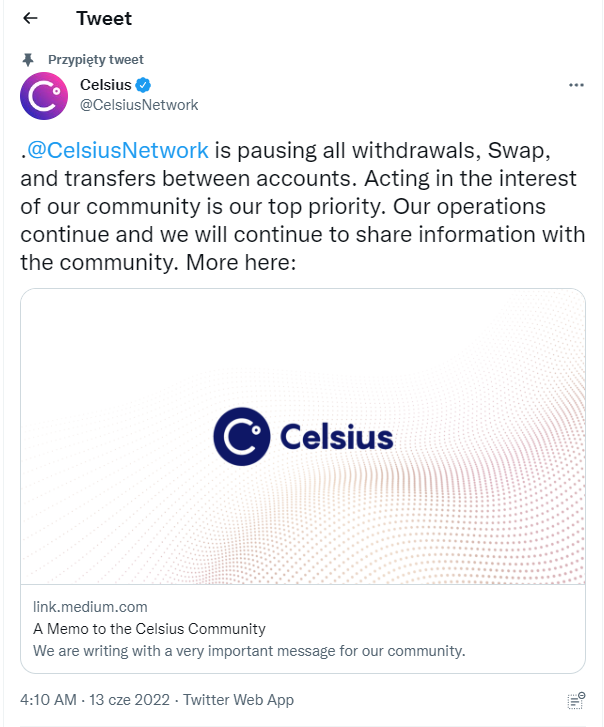

But, on the 12th of June, 2022 – Celsius Network halted withdrawals, swaps, and transfers for its users, officially announcing the pause on the 13th of June, 2022 at 4am.

Ironically, one of Celsius slogans was: Celsius – a wallet that pays you back. Well…

Of course, holding withdrawals, swaps, and transfers made people scared the company is insolvent and may cause an avalanche effect, which triggered yet another crash within crypto.

We still haven’t recovered from the LUNA events! Jeez.

BTW. If you’re still unsure as to what happened with LUNA in May, check out our news on this disaster.

What’s pretty crucial here is that the announcement made by the Celsius Network came AFTER Bitcoin’s value started decreasing. This made people even more anxious about Celsius insolvency.

Celsius Network token CEL value

Celsius Network launched its native token CEL that’s also been pretty bad lately.

CEL served mostly internal purposes for the Celsius Network, including being a payout booster for Celsius users if used as the payment currency. (source)

Here’s a graph showing CEL’s recent value

CoinMarketCap lists CEL value as $0.5259 as of the 16th of June, 2022. While the token’s ATH value oscillated around $8.05 (4th of June, 2021).

The decrease in CEL’s value results of course from the whole situation and the possibility of Celsius insolvency.

Yet Another Hidden Element – Celsius Aave to FTX Transfer

On-chain data shows that there was a few other crucial events leading to Celsius pausing the withdrawals.

Apparently, before halting the withdrawals, swaps, and transfers, the Celsius Network took out million dollars’ worth of crypto assets from Aave and transferred them into the FTX exchange market.

The initial transfer consisted of:

- 3, 500 Wrapped BTC (worth around $89 million at the time)

- 50, 000 ETH

On-chain data tells us that Celsius transferred more than 100, 000 ETH and 9, 500 Wrapped BTC, as well as numerous other tokens.

The total amount of crypto transferred comes up to more than 320, 000 000 dollars.

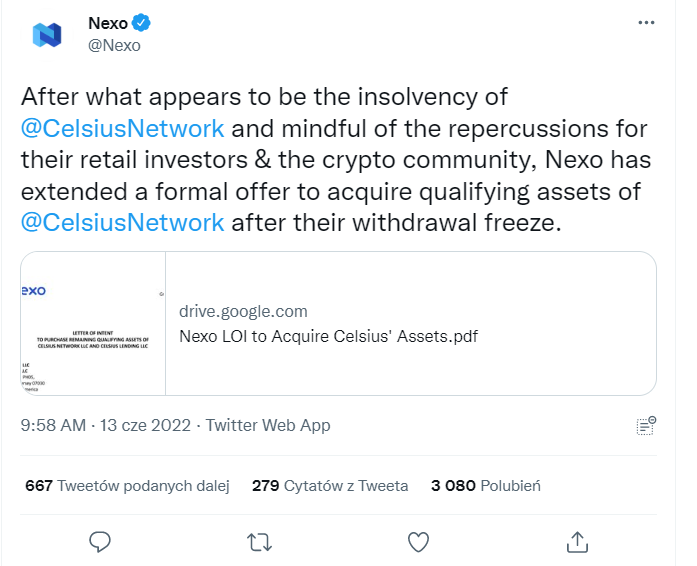

Nexo’s Proposal

To finish off this rollercoaster ride – Nexo – a company launched in 2017 that describes itself as the world’s leading regulated institution for digital assets has made an official offer to the Celsius Network team to acquire its outstanding loan receivables.

Nexo Finance handles more than 4 million users and has already processed over 80 billion dollars.

The company tweeted about the situation saying:

And:

BTC Value in the Middle of the June Crash

Bitcoin was of course not left untouched. The most popular cryptocurrency value slumped, with the price as of 16th of June, 2022 coming to $21,186.77.

Here’s a CoinMarketCap graph presenting Bitcoin’s value over the last year, with its most recent crush:

CelsiusNetwork – UPDATE

The update to this story is just as hectic as the rest of it. So, fasten your seatbelts and let’s go for a ride with Celsius.

Celsius paid off their debt fully

Around July 13th, it came clear that CelsiusNetwork paid off their debt fully having owed over $500 million in cryptocurrency to Compound, Aave, and Maker – three biggest DeFi lenders.

But this did not change the fact that their customers were still unable to withdraw any of their money.

Celsius filing for bankruptcy

The next day, on July 14th, Celsius announced that they’ve decided to voluntarily file petitions under Chapter 11 of the US Bankruptcy Code.

The company is backing the decision by saying that it will help with financial restructuring and stabilization of the company.

Filing the bankruptcy petition under Chapter 11 provides some sort of protection for the Celsisus Network while they try and rebuild the company.

The $167 million owned by CelsiusNetwork is said to help maintain the liquidity and achieve stabilization.

Should Celsius update their stance or announce any important information, you can expect to see it in this article.

Conclusion

A few elements of the puzzle are still missing, including why did Celsius transfer its crypto assets from Aave to FTX or what exactly caused the pause in withdrawals and the possible insolvency of the Celsius Network.

As always, lots of theories are popping out.

Nevertheless, we’re still not 100% sure as to what happened – but we can definitely see the results of this situation – fear and anxiety within the market and the crypto crashing yet again in June, 2022.